OCR SLIP PROCESSING & RISK MANAGEMENT

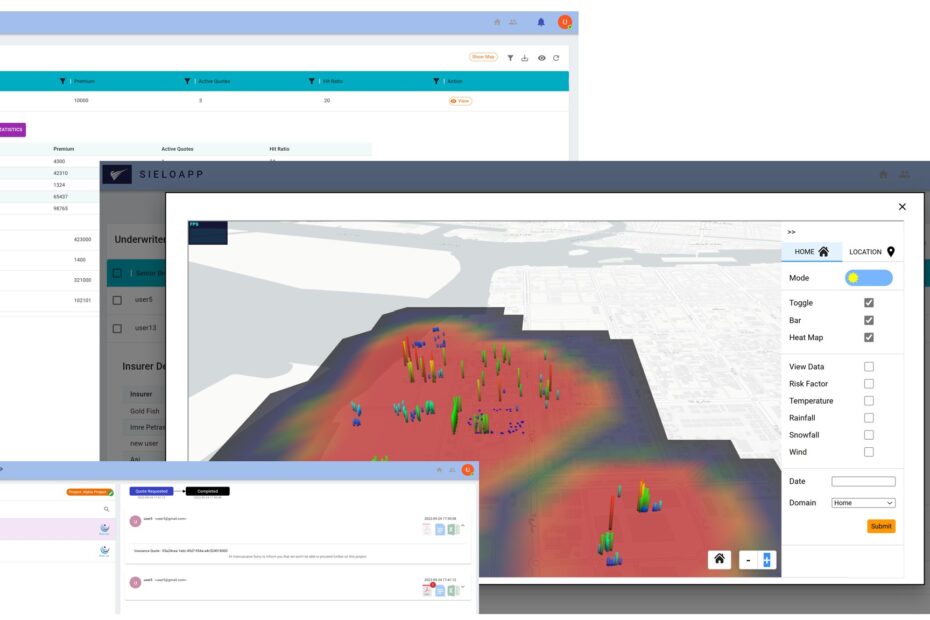

The platform performs OCR on incoming slips to ingest data, extract data, enables corrections and amendments with approval workflows that are configurable for admins, underwriters and senior underwriter functions. Through Snowflake it has improved data reporting enabled to visualise risks subject to incoming data and shares data from incoming weather data as an example for certain perils. The Insurance platform currently is built on Snowflake with Python and Nginx and has reinforced machine learning on data ingestion around OCR and the slip processing.